How do we remove the barriers to accessing quality, safe, affordable housing in our region?

The HIT is a platform that tracks local jurisdictions’ housing production and preservation in the Capital Region to help stakeholders create paths for removing obstacles to opportunity and supporting housing stability.

Discover the complex history of US housing and learn what we can do about itRegional problems require regional solutions

Everyone deserves to have a safe, affordable place to live.

Building and maintaining housing that is affordable for households across the income spectrum helps facilitate regional economic growth, promotes health and wellbeing, and provides a stable platform for people to thrive and prosper. But today, that reality is not fully achieved in our region for everyone.

Central to addressing housing inequities is to ensure that our housing supply is sufficient to meet the area's expected population and household growth and that we are producing more affordable housing to better serve residents who live here now.

The HIT exists to show progress at both the jurisdiction and regional level in the Capital Region. Our economy and housing markets do not end at one jurisdiction's borders.

Greater DC Housing Production, 2024

Source: HIT survey of local jurisdictions

The tool includes regionally specific dashboards that show progress being made at a larger geographic footprint, in addition to the jurisdiction level. The Greater DC, Baltimore, and Richmond regions have estimated goals of 25,013, 8,178, and 4,312 net new units annually, respectively, based on local household growth projections. And while each area may require different combinations of tools to support housing affordability – every jurisdiction has households that are paying unaffordable housing costs.

Greater Baltimore Housing Production, 2024

Source: HIT survey of local jurisdictions

In 2024, the Greater DC region saw 25,930 new units built and the Greater Baltimore region saw 6,980 new units built. The City of Richmond did not report the total number of new units built, but produced 143 new affordable units and preserved 296 affordable units in 2024.

This tool places income and racial inequity at the center of the housing conversation, as we know that households with low and moderate incomes and persons of color have been most affected by rapidly rising housing costs in our region. Achieving a future where Black and brown communities have what they need to thrive and prosper in and between Baltimore, Washington, and Richmond, requires us all to understand the structural racism that contributed to housing insecurity and instability and to proactively map out a path to increase equity in housing outcomes.

As you navigate through the tool, you will be confronted with the realities of housing insecurity and instability that so many face in our region as housing prices rise and incomes remain flat. You will also be confronted with the present-day impacts of discriminatory public policy decisions and private practices – that have created obstacles to opportunity, including racist housing policies and exclusionary land use.

The dashboards included in the HIT are just the beginning. Equipped with the knowledge of where we stand in each jurisdiction, we can effectively pivot to best meet the needs for more housing supply and a more equitable region. To obtain different results and truly solve the housing need, we must increase the resources to support affordable housing and make necessary changes to policies to achieve this goal.

The ripples of historic racism persist in housing outcomes in the Capital Region

As we consider the effects that historic housing policies have had on our present-day affordability crisis, we must look at the policies and practices that compounded over time to create the current housing environment. Even today, we see extreme gaps in wealth, educational attainment, and health outcomes in most major cities across lines of race, and these gaps stem from decades-long systems that have been entrenched in our communities, our policies, and our culture.

The highlighted examples demonstrate the inequities that are built into our housing and economic systems and emphasize the need for leveling the playing field. Explore the linked resources for more insights on these systems and consider your role in fostering housing equity in your work.

Racist Housing Policies

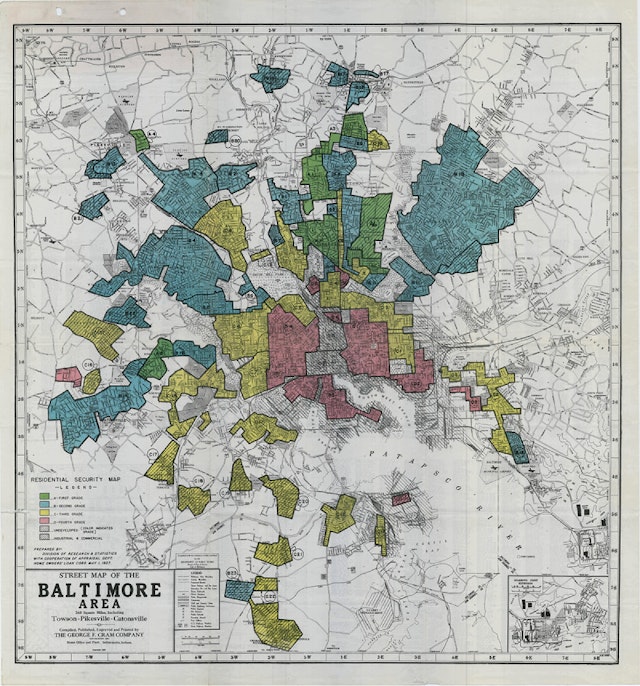

Historic public policies, including racially restrictive covenants and redlining, inhibited Black families from generating wealth. Property owners attached racially restrictive covenants to property deeds, banning Black Americans from buying or renting homes. In the 1930s, the federal Home Owners’ Loan Corporation (HOLC), mapped neighborhoods characterized by their assessment of risk for lending purposes in cities across the US. Majority Black neighborhoods were intentionally categorized as “hazardous” investments and shaded red, resulting in private lenders and banks denying mortgages in these areas.

The National Housing Act of 1934 created the Federal Housing Administration (FHA), which adopted the discriminatory HOLC redlining maps to offer government backed low-interest loans for purchasing homes. These loans helped to drastically increase homeownership in the United States, from 44 percent in 1940 to 62 percent in 1960, and increased the gap in the homeownership rate between Black households and white households from 23 to 26 percentage points.

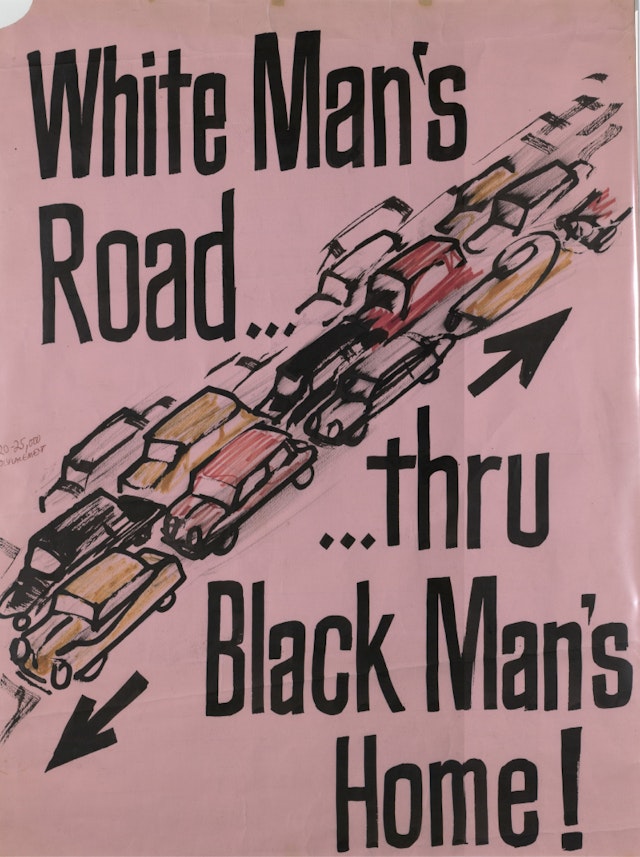

Urban Renewal

Federal urban renewal policies enacted in the 1950s and implemented by local jurisdictions through the 1980s were framed as blight removal and efforts to improve quality of life. However, these policies, combined with federally-funded highway construction, destroyed many communities of color across the country. They displaced Black residents and members of other disadvantaged groups, and using tactics like eminent domain, stripped them of their wealth.

Today, a higher percent of Black and Hispanic children live and attend school near highways or industrial facilities, neighborhood conditions created by federal urban renewal policies. Pollution exposure from highways and industries result in a higher risk of respiratory and neurological diseases.

Exclusionary Land-Use Policies

Jurisdictions passed race-based zoning ordinances in the early 20th century to exclude Black communities and devalue homes in Black neighborhoods. Though race-based zoning regulations were ruled unconstitutional in 1917, local jurisdictions continued to use exclusionary land use regulations to limit housing production and maintain segregation.

Today, cities and towns widely use zoning to prevent or ban the construction of multi-family housing and set rules for building height caps and minimum lot sizes. These zoning regulations resulted in less affordable housing by restricting housing density and preventing the construction of subsidized housing. Wealthier communities, often majority white, also use these regulations to maintain high property costs for wealth accumulation.

Mortgage Discrimination and Subprime Lending

Banks are more likely to deny Black and Latino mortgage applicants than white applicants today, largely stemming from systemic barriers to higher income and credit scores. The devaluation of Black neighborhoods in the US also harms existing homeowners from building wealth from their property.

With the expansion of mortgage lending in the early 2000s, Black homeowners and neighborhoods were targeted with predatory subprime lending. During the 2008 Foreclosure Crisis and Great Recession, Black homeowners saw higher rates of foreclosure. The six percent gain in Black homeownership after the passage of the Fair Housing Act in 1968 was erased between 2000 and 2015. The increase in mortgage denials, losses on home values, and predatory lending prevent Black homeowners from building and transferring wealth to their next generation.

Exclusion from Jobs and Benefits

White supremacy and state-sanctioned racism, such as slavery and disinvestments in education, resulted in a lack of available jobs for Black workers in the early to mid-1900s. As a result, agricultural labor and domestic service workers were the majority of the Black workforce. During the New Deal era, the Social Security Act in 1935 excluded agricultural and domestic workers from unemployment insurance and Social Security. This exemption excluded Black workers from the new federal policies without making race explicit; 65 percent of Black people (up to 80 percent in the south) did not qualify for Social Security or unemployment insurance.

These historical limits still have implications for people of color today. In DC, Black workers are more likely to work in the service industry and manual labor, which pay lower wages, and have fewer benefits. The resulting lower incomes constrain people’s housing choices and put them at higher risk of facing housing instability.

Who can afford to live in the region?

In order to better understand how rising housing costs affect our neighbor’s ability to live in this region, the interactive tool below illustrates how people of different races, occupations, and incomes are affected. Please click on an individual card to learn more about each person. As you move the slider to the right, monthly housing costs increase and you will notice some faces disappear and are labeled as “housing insecure.” These households have housing costs that exceed 30% of their monthly income and are more vulnerable to homelessness and economic shocks.

Note: Though the characteristics of each individual are generated from data on real people, the faces of the individuals used are fictitious.

CEO

Single

Pharmacy Technician

Married, 1 child

Pharmacist

Married, 1 child

Software developer

Single, 1 child

Accountant

Single

Firefighter

Single, 1 child

Primary school teacher

Single

Hotel desk clerk

Married

Childcare worker

Single

Auto repair mechanic

Married, 2 children

Registered Nurse

Divorced

Plumber

Single

Preschool teacher

Single

Home health aide

Divorced

Landscape worker

Single

Retail sales worker

Single

Construction worker

Married

Mental health counselor

Separated

Graphic Designer

Single

Cleaner

Divorced

Emergency Medical Technician

Single

Postal service mail carrier

Single

Fast food worker

Married

Retired

Divorced

What policies are needed to increase affordability in our region?

No two jurisdictions are alike. We know that the right combination of housing, land use, and economic development policies in each jurisdiction are needed to generate the housing production and preservation outcomes we seek as a region, for both affordable rental and homeownership housing options. The table below also includes policies related to reducing greenhouse gas emissions and energy costs in housing and protecting vulnerable residents from the impacts of climate-related events.

In the table below, you will see our list of policies that we believe comprise a comprehensive Housing Toolkit. These policies have been grouped in three categories: Preserve, Produce, and Protect. We encourage you to learn more about each policy and look at your jurisdiction’s dashboard to see which policies have been adopted

Right of first refusal

Right of first refusal policies give tenants, mission-oriented developers, or local governments the opportunity buy rental properties that are being sold so that they can be preserved as affordable housing. Typically the right of first refusal purchaser must match a legitimate market offer for the property or has an exclusive period when it can make an offer. Local governments often do not retain properties obtained this way but will offer them to nonprofits or others for redevelopment. In Virginia, current state law limits local governments to implementing such a policy to buy ADUs that come up for sale or properties they have otherwise subsidized.

Tracks subsidized affordable housing preservation and maintains inventory

A database of subsidized affordable properties can be a tool for local governments, affordable housing developers, tenant organizers, and legal assistance providers to collaborate on preservation responses and strategies. A preservation inventory can identify properties with expiring subsidies or that are otherwise at risk of losing affordability and help communities organize coordinated preservation actions.

Tracks unsubsidized affordable housing preservation and maintains inventory

A database of unsubsidized but affordable rental properties can be a tool for local governments, housing developers and owners, tenant organizers, and legal assistance providers to collaborate on preservation responses and strategies. An inventory of these properties can help stakeholders to work together to proactively to preserve affordability by highlighting rehabilitation needs, redevelopment opportunities, and keep existing residents from being displaced.

Rental Assistance Demonstration program

The federal Rental Assistance Demonstration (RAD) program allows public housing authorities (PHAs) to convert public housing and some types of project-based assisted housing to project-based rental assistance. RAD allows PHAs to leverage private and public financing to support the renovation of these units, many of which have suffered from disinvestment.

Assistance with Energy Efficiency Upgrades for Homeowners with Low and Moderate Incomes

Homeowners with low and moderate incomes are more vulnerable to the impacts of climate change and have more limited resources to retrofit their homes though energy audits, home weatherization, and other energy efficiency updates. Local governments can provide funding or tax subsidies to help homeowners make their homes more energy efficient, reducing energy cost burden and greenhouse gas emissions.

Assistance with Energy Efficiency Upgrades for Affordable Housing Owners

Renters in affordable housing developments could particularly benefit from the reduction of utility costs associated with green retrofits of buildings to weatherize and improve energy efficiency. Local governments can provide funding or tax subsidies to incentivize owners of these properties to make these upgrades and maintain affordability.

Change is happening in our communities

See the progress of your jurisdictionDo more than make a statement,make a difference

Track your Jurisdiction with the HIT

Knowledge is power. Learn about the housing needs in your jurisdiction, what policies and practices are in place, and what progress has been made towards meeting the need.

Explore the DashboardsUniquely Leverage your Organization

Every individual and organization has a role to play in creating a more equitable Capital Region. Take a look at ways you can act today.

Explore Calls to ActionEmail your Elected Officials

Use this template to email your elected officials about the importance of prioritizing the housing targets and implementing the policy toolkit to support the production, preservation, and protection of affordable housing. Check out your jurisdiction’s dashboard to customize your letter and locate contact information.

Access the Template EmailAttend an Activation

Join us for activation events with speakers representing the various sectors and stakeholders in the housing ecosystem that explore how jurisdictions and industry professionals are responding to our region’s housing needs.

View Upcoming ActivationsGet Social

Your voice matters. Use these template posts to make the case for housing production on social media. Follow us and use the hashtags to get in on the discussion

Check out the ToolkitDonate

Looking for a way to support this work? Consider making a donation to advance and sustain the HIT.

Donate HereDiscover Additional Resources

Want to download the data for yourself? Need a quick summary of the tool? We have additional resources to help you learn more about the HIT and to support your work.

View ResourcesHIT Newsletter

Sign up for our Advocacy & Policy Alerts to stay in the know on HIT happenings and other advocacy and policy updates from around the region.

Newsletter Sign up